ProMarket: Reregulate.

Lee Hepner and William J. McGee respond to Clifford Winston’s ProMarket piece asserting that further deregulation of the airline industry would resolve problems in the industry. Instead, the authors claim a return to regulation would produce better results for travelers.

With the airline industry undergoing repeated crises, and with passengers more frustrated than ever, there is an increasing call for government intervention. For the first time in decades, there is serious reconsideration of whether the industry should have been deregulated in 1978 with the Airline Deregulation Act. In our view, deregulation, which gave private entities sweeping abilities to set routes and fares, has been a failure. The deregulatory regime has fostered higher prices, less competition, worse service, lower profits, and less access to the air grid than would otherwise be the case.

There is another model to examine as a possibility. Prior to the Airline Deregulation Act, from 1938-1978, the federal Civil Aeronautics Board comprehensively assigned routes to airlines and set passenger fares. In light of longstanding and ongoing difficulties, we advocate for public control of price and route-setting.

Despite the multiple crises in the airline industry in the last year – hundreds of thousands of canceled flights, Southwest Airlines’ holiday meltdown that stranded more than 2 million passengers, and the FAA’s system crash – Clifford Winston recently reasserted here in Promarket that “economists are still right about deregulation.” Winston makes three main points to assert this: that airline fares have fallen dramatically since deregulation in 1978, that price caps imposed by regulation would harm the industry, and that many of the discomforts of flying today are the result of consumers revealing their true preferences for low prices above all else. Each of these points either is misleading or misrepresents the motivation for regulating the airline industry, whether in 1938 under the Civil Aeronautics Act or potentially again today.

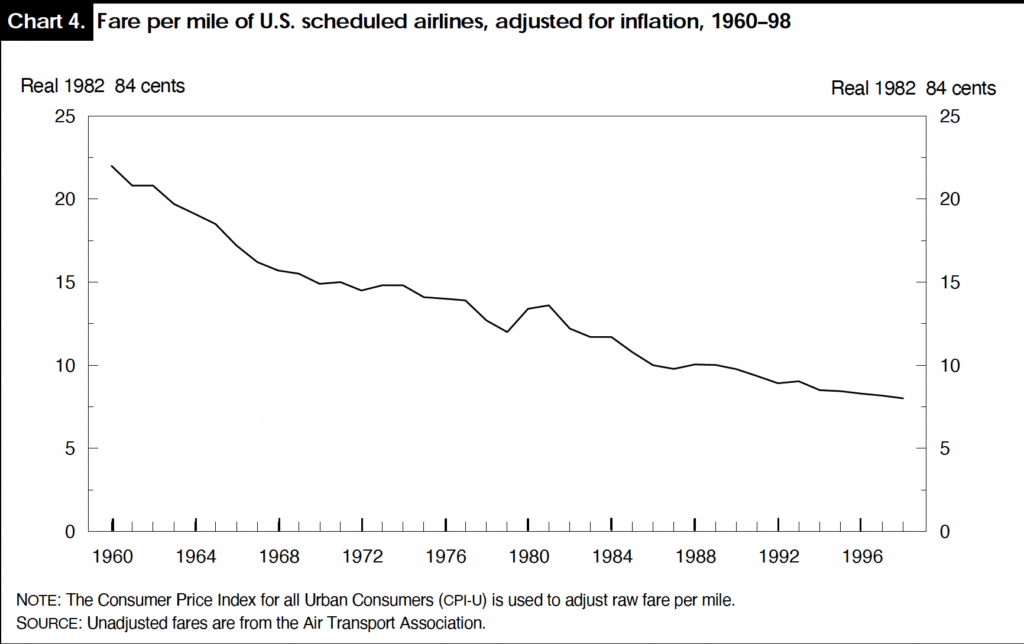

Let’s start with Winston’s primary contention that prices have fallen since deregulation. This would seem like a reasonable argument, except that airfares were already falling, and faster, prior to 1978 deregulation, as reported by the industry’s largest lobbying organization, Airlines for America (formerly Air Transport Association):

Other research has confirmed this. Airfares actually decreased more in the decade prior to deregulation than they did in the decade after deregulation. As shown above, airfares started dropping in 1962 and continued falling through 1985, with the one period of sustained increase occurring between 1979 and 1981, right after deregulation took effect. In 2007, economist David B. Richards concluded regarding airline deregulation: “Except for the period immediately before the terrorist attack in 2001 and continuing through 2005, there are limited, if any, demonstrable domestic system passenger fare savings.”

The historic decline in airline fares had many drivers that had little to nothing to do with deregulation, such as increased reliability and a decline in fuel costs and other efficiencies generated by the launch of commercial jet service in the late 1950s and larger widebody aircraft in the early 1970s. The trend in fares suggests that deregulation had a negligible if not adverse impact on fares.

Furthermore, in many cases we do not even know what average fares are today. A range of ancillary junk fees – bag fees, seating fees, ticket transfer fees, and so on – have obscured the real cost of fares while degrading service for those who can’t afford basic amenities. What used to be viewed as routine services – checked and even carry-on baggage, pre-assigned seats, ticket changes, meals/snacks, etc. – have become paid extras.

Fares are also wildly different for different regions. Major urban centers today may have relatively reasonable airfares due to the presence of low cost carriers and ultra low cost carriers, but smaller and rural regions of the country will find flying entirely unavoidable if there is even service at all. Unless you live in a major hub, reorientation of routes around hub-and-spoke airports means most people are now taking connecting flights, which increases the price of travel for most passengers. The distribution of that burden disproportionately harms passengers in rural and “fly-over” areas, restricting travel and compounding geographic inequities.

Second, Winston highlights the airline industry’s “fickle” prosperity as a reason against regulation: “Suppose regulators appeased those who claim that flying costs too much by putting a cap on airfares. The airline industry has periods of fat profits, but those profits are notoriously fickle.” To this we say: exactly. Under deregulation, the airlines have not even been a profitable industry. Regulation is not meant to cap prices and push fares even lower, but rather to set reasonable fares that would prevent a high-fixed-cost industry, like airlines, from falling into cycles of price wars, bankruptcies, and consolidations. We have seen this come to pass since deregulation.

Winston’s points align with arguments that have become conventional, misplaced wisdom about airline deregulation: that regulation increased prices, blocked competition, was slow and burdensome, and harmed consumers. As we have highlighted, many of these points do not hold up to scrutiny, but moreover, this diagnosis ignores many of the very real problems that the industry faces today: an unprecedented level of concentration, the reliance on federal largesse to bail out the industry in intermittent crises, the dramatic regional inequalities in air service and price, and the clear lack of reliable service that the industry provides today.

Winston’s article also lacked evidence to support the presence of competitive “fare sales” in the current airline market. In reality, the Big Three major domestic carriers all but abandoned such head-to-head initiatives 20 years ago. In another instance, Winston suggests that if “policymakers force an airline that cancels a flight to immediately provide a cash reimbursement to all affected passengers,” the result of causing airlines to absorb that risk would result in higher fares. Setting aside the inference that it would be better for passengers to absorb the cost of airline failures, Winston misses the fact for years the Department of Transportation has had such a cash refund rule in place, even though U.S. airlines have repeatedly violated it.

Even the architects of deregulation came to terms with these realities long ago. Reflecting on the status of deregulation in 1988, former Chair of the Civil Aeronautics Board and principal architect of deregulation Alfred Kahn remarked that he was unprepared for the “massive restructuring of routes” and the “bankruptcies and consolidations” that had manifested in the decade after the ADA. By 1990, more than 200 airlines had gone bankrupt or been acquired in mergers. Airlines in direct competition ignored fixed costs, engaged in price wars and distressed-sale pricing that obliterated profits, and carriers seized monopoly opportunities in regional and city-pair markets to stem the losses from destructive competition. To invoke just one example, Southwest Airlines oriented its service around less-congested airports, and as a result its airport-pair concentration level was 20 percent higher than the industry average.

Today’s industry is more concentrated than at any point in the industry’s history, and far more concentrated than the pre-1978 market conditions that fueled calls for deregulation. An oligopoly of four major carriers – American, Delta, Southwest, and United – controls 80% of the domestic market. Due to common ownership by financial institutions, we recently had the longest drought of new airline entrants in airline history, with not a single new-entrant airline from 2007 to 2021.

Even despite this consolidation, the industry’s instability still leads it to need frequent bailouts, whether after 9/11, after the 2008 financial crisis, and most recently with the pandemic. We didn’t hear cries for deregulation when the federal government issued a $54 billion bailout of the airline industry during the pandemic. Instead, we saw airlines misappropriate those funds for stock dividends and encourage early retirements of pilots, leading to an industry-wide staffing shortage and meltdown when passengers returned to flying.

The private market will not solve the problems created by excessive and destructive competition. Only with regulatory safeguards and oversight can we turn the page on a race-to-the-bottom environment that has harmed consumers, safety, innovation, and workers. The solutions proposed by advocates such as Winston – to further deregulate by privatizing airports, for example – are ill-conceived, but more importantly, they do not even grapple with the structural issues that the industry faces in reality today.

Articles represent the opinions of their writers, not necessarily those of the University of Chicago, the Booth School of Business, or its faculty.