Stock Buybacks and the Coronavirus Crisis

To: Interested Parties

Fr: Sarah Miller, Executive Director, Economic Liberties Project

Re: Stock Buybacks and the Coronavirus Crisis

![]()

Stock buybacks emerged during the deregulation frenzy of the mid-1980s as a way for corporate executives to push up their corporations’ stock prices to further enrich themselves. While they’re great for the largest corporations’ top brass, they erode corporations’ resiliency, undercut firm investment, undermine macroeconomic stability, and exacerbate inequality.

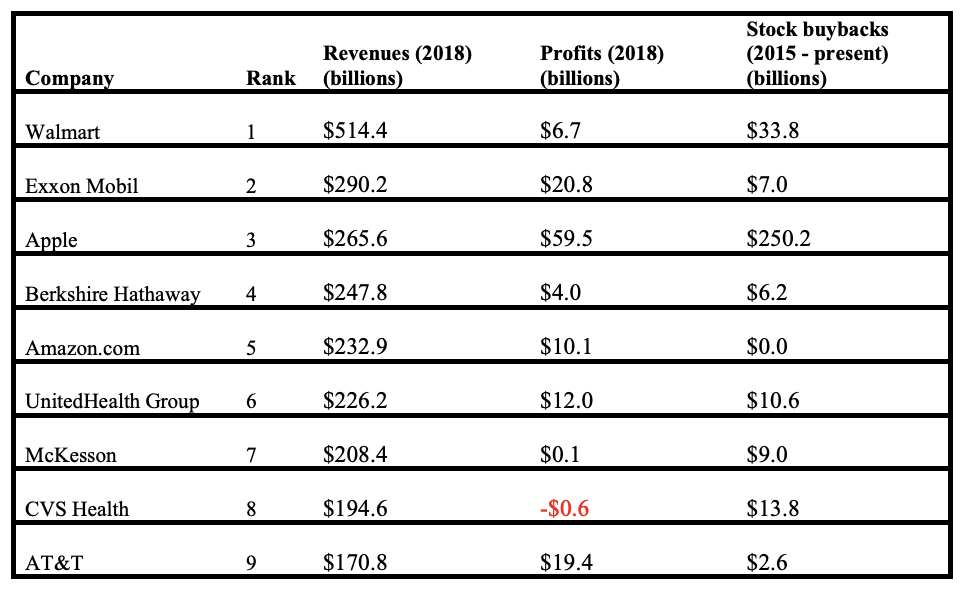

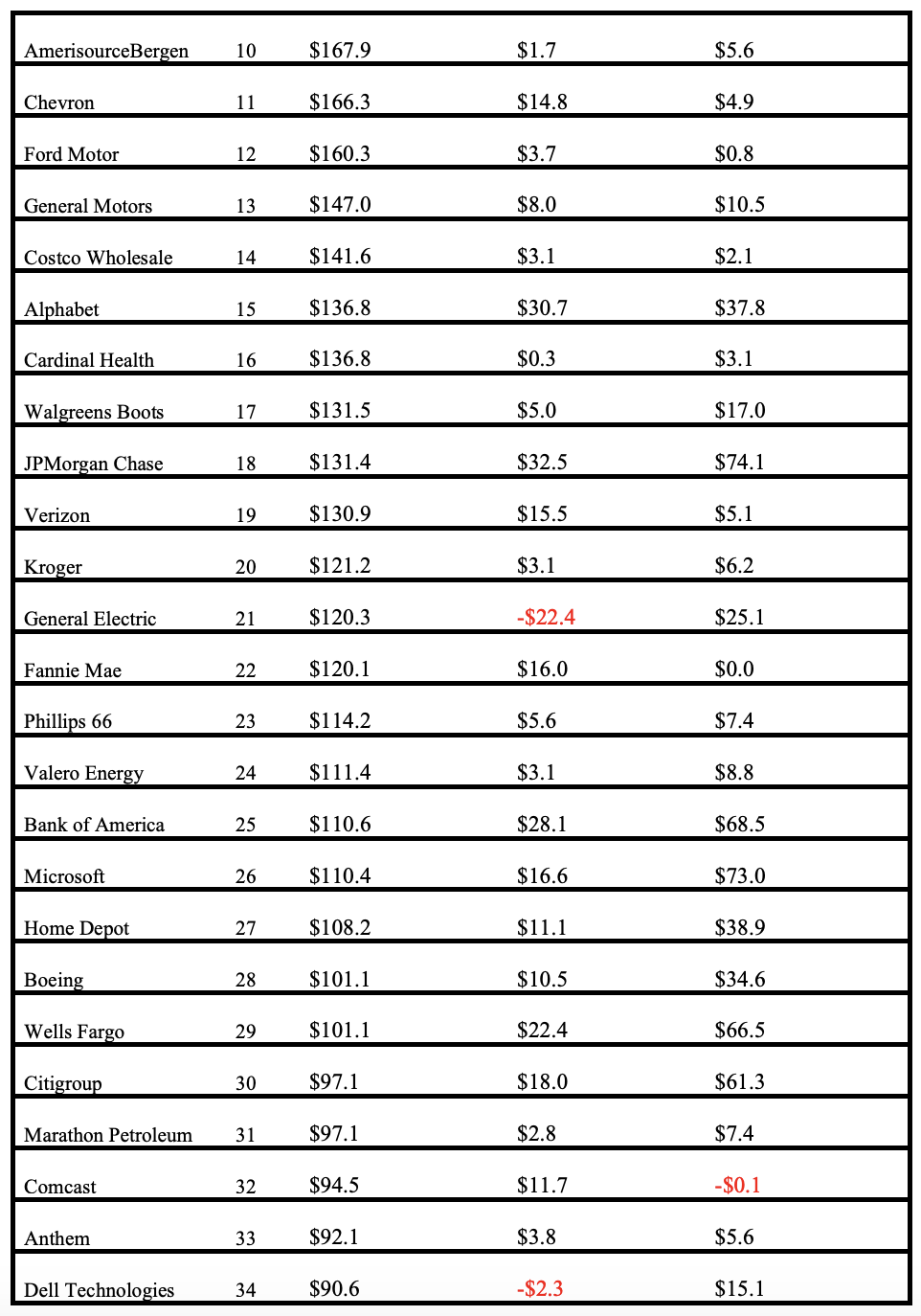

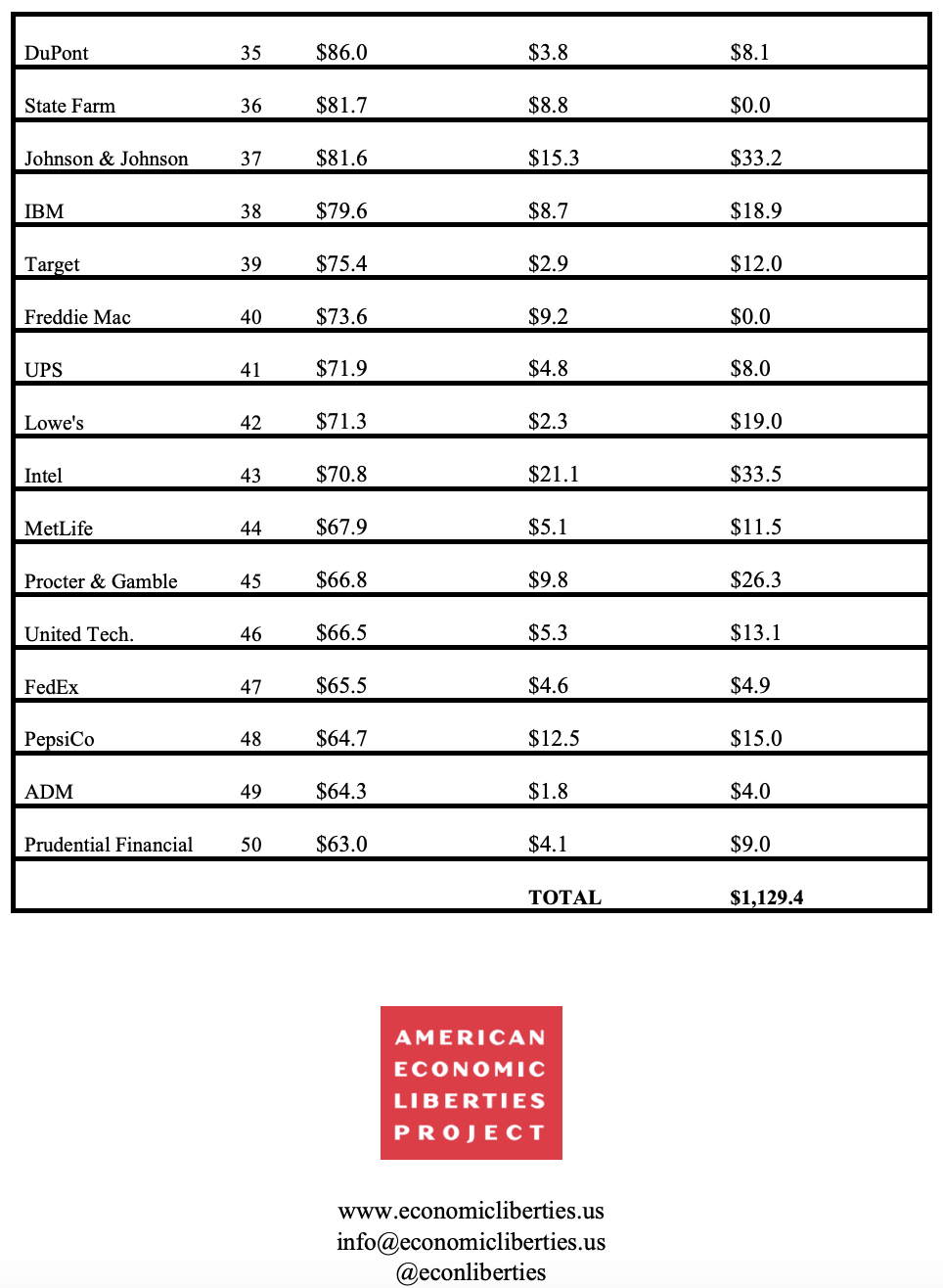

Over the last five years, the 50 largest U.S. corporations repurchased a staggering $1.1 trillion in their own stock. Now, corporations affected by coronavirus are turning to taxpayers for bailouts. Just yesterday, for example, Boeing requested $60 billion in federal support, even though executives have spent more than $35 billion repurchasing their own stock in the past five years.

It’s past time for Congress or regulators to ban stock buybacks, but the coronavirus crisis puts the urgency of this important step in sharp relief. Below, we provide data on the top 50 U.S. corporations’ stock buybacks to help spur policymakers to end this dangerous and socially harmful practice.