Competition at a Crossroads: A Comparative Guide to Recent White House Records on Antimonopoly Policy

By Laurel Kilgour and Matt Stoller

Since the financial crisis of 2008, Americans have come to realize that we face a monopoly crisis, a set of “Too Big to Fail” corporations in many sectors across our economy that foster a host of problems, from harming small business formation to hiking prices for consumers to fostering shortages in key goods to structuring key avenues for speech. Even excluding concentration trends from prior decades, 75% of U.S. industries became more concentrated between the year 2000 and 2015. Profit margins of large firms are at 70-year highs, and the labor share of income has fallen 10% since 1970, with rent extraction as the culprit. The number of public corporations has fallen by more than half since the 1990s, largely due to mergers.

During and after the COVID-19 pandemic, an inflationary spike allowed corporations to reap high profits, leading to increased political support for taking on corporate power, with a majority of voters across party lines supporting measures to reduce consolidation. One of the most important domestic policy choices the next president will have to make is how to tackle America’s concentration crisis.

In this report, we review the records of the Trump-Pence and Biden-Harris administrations, up through mid-October 2024, in fighting to halt — and ultimately reverse — this trend. Although a full accounting of each administration’s broader impacts on America’s political economy is beyond the scope of this report, we note that it would require an assessment of monetary, trade, tax, and industrial policies, among others. This report focuses on a specific set of policies relating to antitrust and fair competition, which were implemented by agencies whose budgets are currently a small fraction of others with economy-wide scope. Broadly speaking, we found that the Trump administration made notable progress in initiating a revival of antitrust enforcement by launching monopolization cases against Google and Facebook, but overall struggled to break from four decades of pro-consolidation orthodoxy.

The Biden-Harris administration has had a more aggressive and focused approach. Ideologically, leaders of the Federal Trade Commission and the Antitrust Division of the Department of Justice restored competition policy to its original rich set of aims, moving away from a narrow technocratic approach to one incorporating how competition impacts consumers, workers, and small businesses. To operationalize this new framework, enforcers did three things. First, they addressed rampant consolidation via new merger guidelines and a merger deterrence litigation strategy. Second, they focused on dominant intermediaries, first by restoring monopolization law with the first successful lawsuit in two decades, against Google, and then by reviving enforcement against unfair methods of competition, exclusive dealing and tying arrangements, price discrimination, and kickbacks. Third, they have democratized regulation. The FTC holds public meetings, launched a new open merger examination process, and has incorporated public feedback as a key mechanism for policy formulation. The DOJ and FTC have also helped other agencies solicit more public feedback.

On the enforcement front, Biden-Harris enforcers brought to trial four times as many billion-dollar merger challenges as Trump-Pence or Obama-Biden enforcers did. The Biden-Harris administration also filed two and a half times as many monopolization claims (Apple, Amazon, Meta, Live Nation/Ticketmaster, Google adtech) and won the first major monopolization claim against a Big Tech firm in a generation.

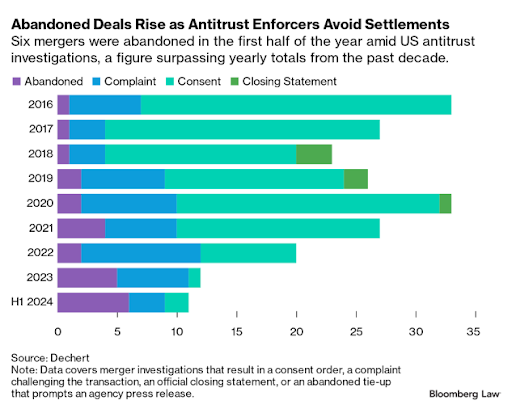

The purple bar in the below chart illustrates the different impacts of the two administrations’ enforcers on the dealmaking climate.

The antitrust enforcers that Biden appointed have not just been bolder in temperament than their predecessors but have also made a concerted effort to review the full extent of their statutory authorities to ensure that they have faithfully applied the laws they are charged with enforcing.

Our recommendations for the next administration include vigorously supporting current antitrust litigation to pursue bold remedies, endorsing congressional proposals to strengthen antitrust laws, undoing problematic mergers, reviving dormant enforcement tools, engaging in a sustained legislative- and executive-branch campaign to break up and regulate dominant corporations across the economy — and making appointments across government aligned with these goals. Effectively tackling America’s concentration crisis requires having the courage to challenge powerful corporate interests. With strong executive backing and this roadmap in hand, key personnel can hit the ground running and continue the fight to restore the promise of America’s free enterprise system through competition policy.