The Depth of Live Nation’s Dominance

By Krista Brown

The live event industry is a multi-billion-dollar industry that continues to grow every year. One of the key drivers of revenue for this industry is live concerts, especially for the artists who make the vast majority of their income touring. In 2010, touring made up 82 percent of artists’ income, and by 2022, it made up roughly 95 percent.

Live Nation/Ticketmaster is the largest entertainment company in the world, dominating almost every corner of the live events, and more specifically, live music industry. This includes concert promotion, ticketing, artist management, and venue operations. This integrated market power gives Live Nation a significant advantage in the industry, where it can leverage one business line to maintain dominance and stifle competition in another.

Ticketmaster’s control of the primary ticketing market has been heavily scrutinized, but that is just one piece of the puzzle. Live Nation uses its promoter and artist management business lines as bargaining chips to gain exclusive contracts with venues. In one instance in 2013, three years after Live Nation merged with Ticketmaster, Live Nation was found diverting a Matchbox Twenty tour (which it was promoting) from a popular arena, because the venue had replaced Ticketmaster with another ticketing provider. This is just one of the countless ways Live Nation uses its web of businesses to maintain market power.

In December 2022, it was reported that the Department of Justice had opened an antitrust investigation into Live Nation’s monopoly power. And in January 2023, the Senate Judiciary Committee held a hearing with industry stakeholders, including Live Nation’s President, to determine if unfair methods of competition were being used by the dominant players in the space. While the hearing started an important conversation, by nature, it did not get into the hard numbers around market capture. Senator’s submitted questions for the record that asked for some of this data, but Live Nation responded with indirect answers.

To gain a clearer picture of the company’s control over the music industry specifically, it is necessary to examine the number of meaningful competitors, or lack thereof, that operate and service the concert venues that make up the majority of annual sales in live music. While Live Nation claims to have significant competition, the data analysis below tells another story.

By collecting data on the top concert amphitheaters and arenas worldwide, along with their corresponding ticket sales, geographic location, ticketing provider and venue operator, Economic Liberties provides granular insight into Live Nation’s true power over the live music industry.

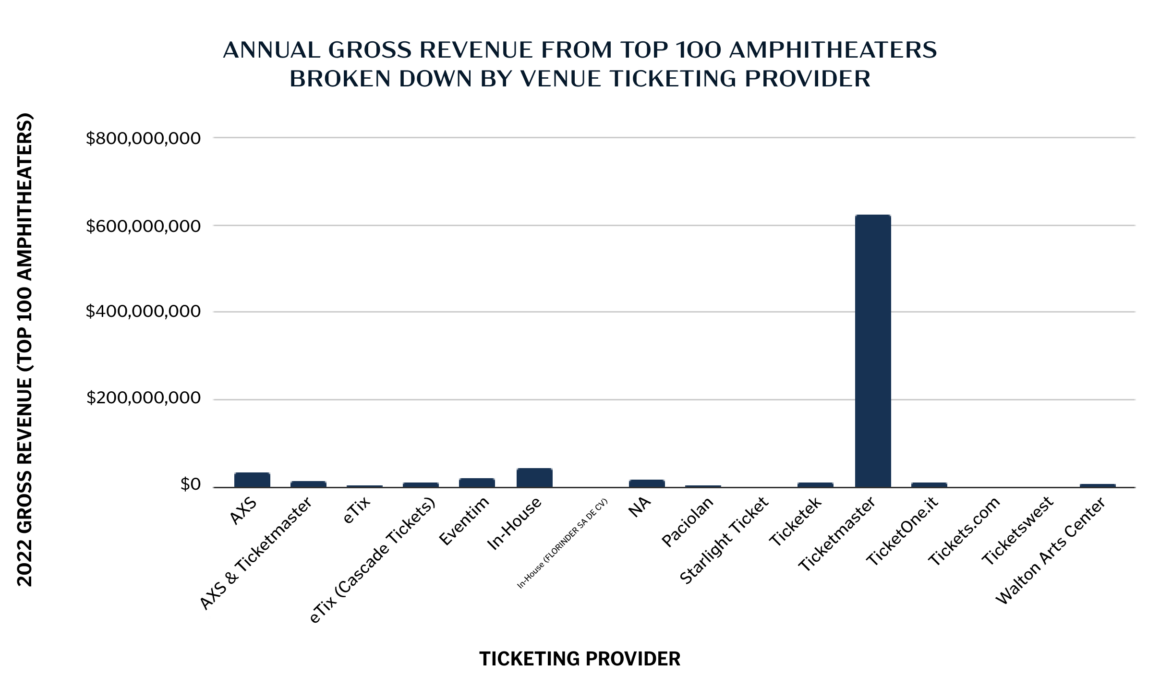

There are other concert venues, such as theaters, stadiums, and clubs, but capturing the top arenas and amphitheaters alone is meaningful. These 300 venues alone made up almost 50% of the total concert sales in 2022, with the top 100 amphitheaters bringing in $814,044,679 from ticket sales, and the top 200 arenas bringing in an astounding $4,489,393,043 from ticket sales.[1] And as the data shows, Live Nation/Ticketmaster dominates each venue market, making it the exclusive backbone for the majority of the concert business.

This data provides insights into the most profitable concert venues and the number of tickets each venue sold in 2022. The data also shows how just a few venue operators and ticketing providers–mainly Live Nation/Ticketmaster–serve these top amphitheaters and arenas.

Understanding this aspect of the music industry can help inform the public and industry stakeholders that engage in contract negotiations. Additionally, this data can help identify trends in the industry and provide granular market information for regulators looking to maintain fair competition in the sector.

The data gathered below also provides direct answers to some of the questions raised in the January 2023 Senate Judiciary hearing, where, for instance, lawmakers asked “how many of the top 100 arenas does Live Nation ticket today?”

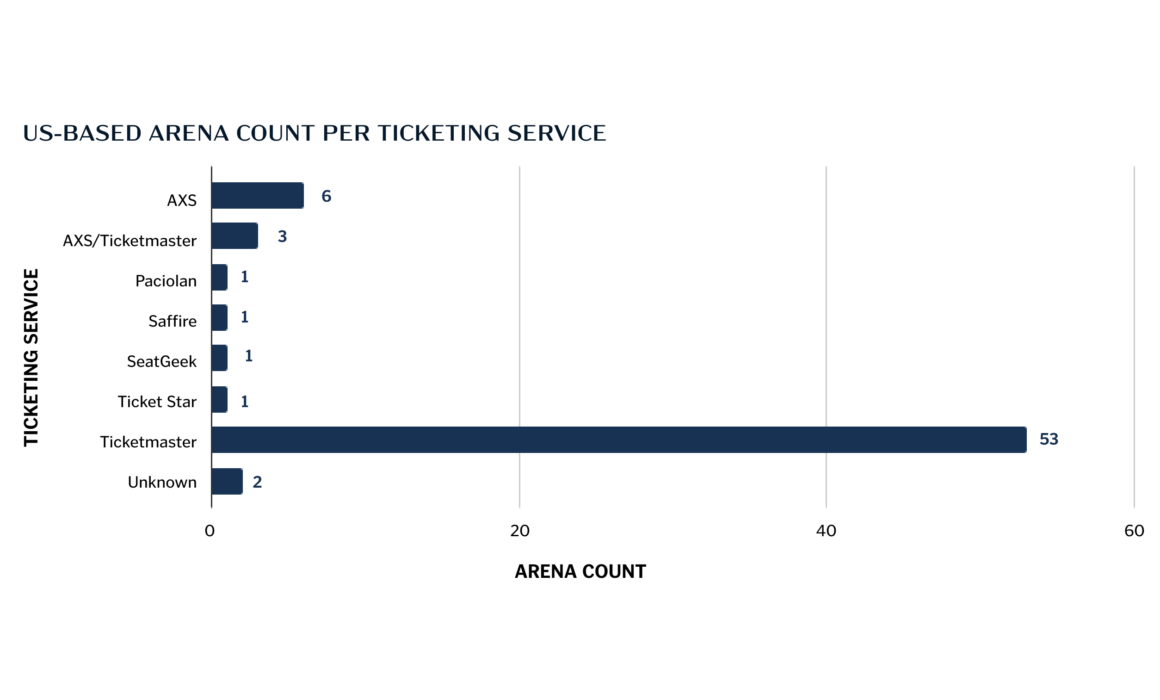

Live Nation did not give any information on arena ticketing in its written response, but our data shows that of the top 100 arenas worldwide, 68 are US-based, and Live Nation/Ticketmaster tickets 78 percent of that US subset.

Amphitheater Data Overview

According to PollStar’s 2022 venue data, the 88 of the top 100 amphitheaters are located in the United States.

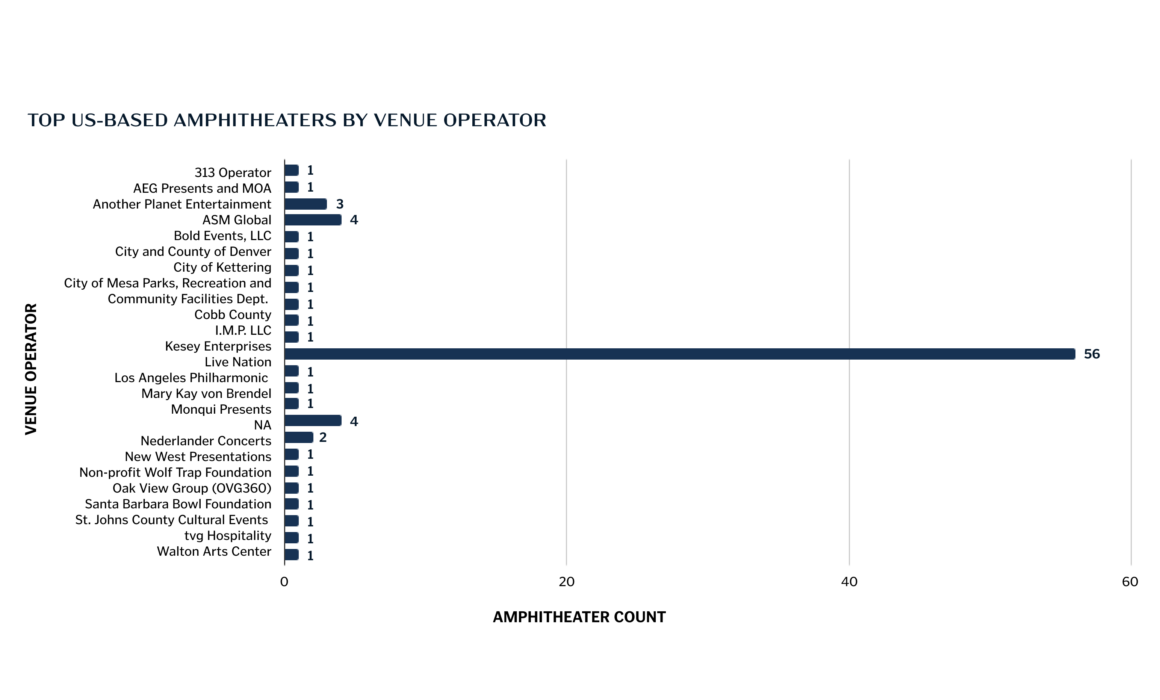

Out of these 88, 56 of them are operated by Live Nation, which means that Live Nation operates the majority (64%) of the top grossing amphitheaters in the United States. With control over these venues, Live Nation is able to leverage that power to dominate ticketing and other segments of the industry.

Supporting the idea that Live Nation does in fact use this position to leverage an advantage for its own ticketing service, of the top 100 amphitheaters worldwide, Ticketmaster was the sole ticketing provider for 77%. When limiting the scope to the 88 domestic amphitheaters, Ticketmaster was the sole ticketing provider for 82%.

This data further supports the concern that there is no meaningful competition in venue operations or ticketing for concerts at US-based amphitheaters.

Arena Data Overview

The arena data presents a similar story, where Ticketmaster faces essentially no competition as a ticketing provider for concerts at US-based arenas. Among the top 100 arenas worldwide, 68 are based in the US and 53 of those are serviced by Ticketmaster. That means Ticketmaster services 78% of the top grossing arenas in the country.

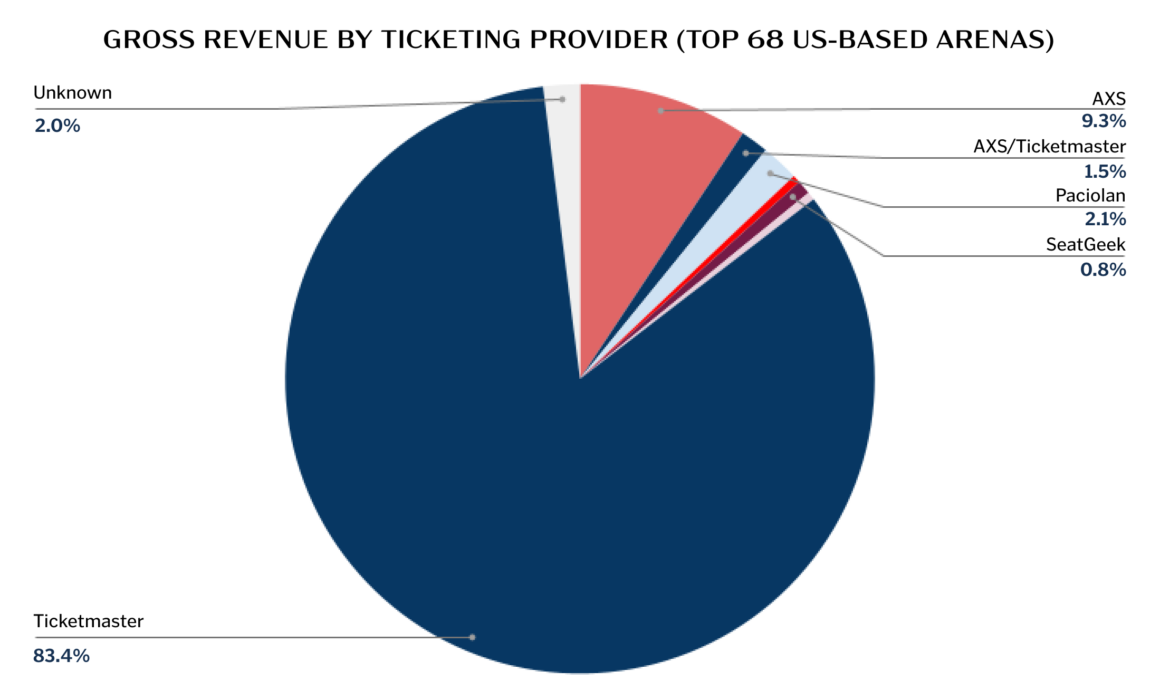

While it is difficult to get data on every single concert venue in the United States, the control over arenas paints a meaningful picture. These 68 US-based arenas generated a total of $2,911,651,970.00 in revenue. And Ticketmaster-serviced arenas contributing an overwhelming 83% of the gross revenue, reaching $2,429,105,432.00.